Nvidia has once again taken center stage on global markets after releasing quarterly results that comfortably beat Wall Street expectations. Revenue for the three months to October surged on the back of relentless demand for its artificial intelligence focused chips, sending the share price higher in after hours trading and calming some of the recent anxiety around an AI driven stock market bubble.

The company, now widely described as the world’s most valuable stock market listed firm, has become a key barometer for the health of the AI boom. Its latest earnings report and outlook are therefore watched not only by its own investors, but also by anyone trying to understand whether AI spending can continue at its current pace.

Nvidia’s Latest Results At A Glance

For the quarter ending in October, Nvidia reported revenue of about 57 billion dollars, representing growth of roughly 62 percent compared with the same period a year earlier. That figure came in above analyst estimates, which had already been set at an ambitious level given the company’s extraordinary growth in previous quarters.

The core engine of this performance was the data center division, where sales rose to more than 51 billion dollars. This business provides the powerful graphics processing units, or GPUs, that drive large scale AI training and inference workloads in global data centers. Data center chips now account for the vast majority of Nvidia’s total revenue and are the main reason why the company has pulled so far ahead of traditional semiconductor peers.

Looking ahead, Nvidia guided for revenue of around 65 billion dollars in the upcoming quarter, again above consensus expectations on Wall Street. That forecast signalled that management still sees strong order visibility from cloud providers, large technology platforms and emerging AI players, despite recent volatility in technology stocks.

Quick Summary Table

Key Detail |

Information |

|---|---|

Company |

Nvidia Corporation |

Latest Quarter Revenue |

About 57 billion dollars, up roughly 62 percent year on year |

Data Center AI Revenue |

More than 51 billion dollars from AI focused data center chips |

Next Quarter Revenue Forecast |

Guidance around 65 billion dollars, ahead of analyst expectations |

Share Price Reaction |

Shares rose around 4 percent in after hours trading |

Main Growth Driver |

Surging demand for AI GPUs and Blackwell based systems |

Market Concern |

Ongoing debate about a possible AI valuation bubble |

Official Company Website |

|

Investor Relations Information |

|

AI And Data Center Focus |

Nvidia positioned as core supplier for global AI data centers |

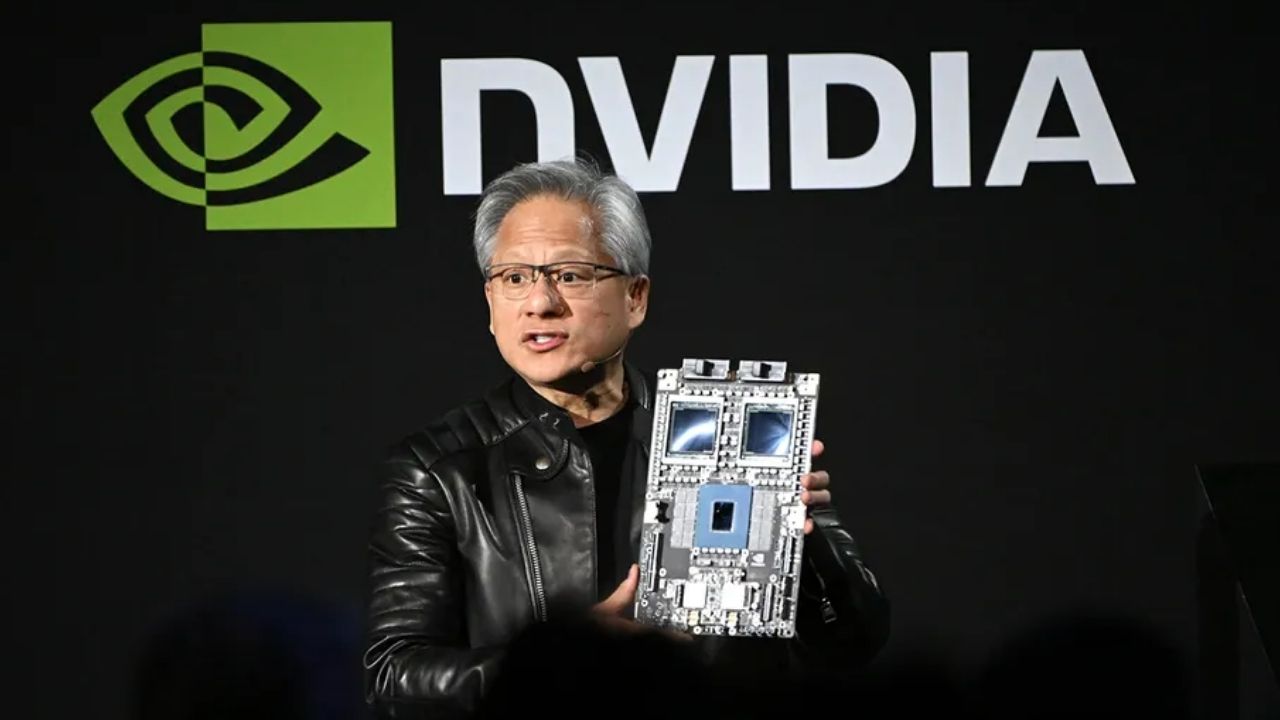

CEO Jensen Huang’s Message On The AI Boom

Chief executive Jensen Huang struck an emphatically optimistic tone in his comments to investors. He highlighted what he described as off the charts demand for the company’s latest generation AI platforms, often referred to as Blackwell systems, and said that cloud GPUs were effectively sold out.

Huang directly addressed growing talk of an AI bubble in financial markets. From Nvidia’s vantage point, he argued, what is happening is not an overheated speculative phase but a structural transformation in computing. He pointed to three overlapping shifts

- The move toward accelerated computing

- The rapid adoption of generative AI

- The emergence of more advanced forms of AI, including agentic and physical AI such as robotics and autonomous systems

His message to investors was that Nvidia is positioned at the heart of each of these transitions and that the company aims to excel at every phase of AI deployment, from training massive models to running them efficiently at scale.

Market Reaction And Ongoing Bubble Fears

Leading up to the earnings release, nervousness about AI valuations had grown. Major market indices had fallen for several consecutive days as investors questioned whether the huge sums being poured into AI infrastructure would generate sufficient long term returns.

Against that backdrop, the bar for Nvidia was very high. Analysts were not asking whether the company would beat expectations, but by how much. The strong numbers and upbeat guidance answered that question and helped stabilise sentiment, lifting Nvidia shares by roughly 4 percent in after hours trade and providing some relief to the wider technology sector.

Even so, some experts continue to warn that parts of the broader AI ecosystem may still be priced too aggressively. While large, profitable companies like Nvidia may justify premium valuations, there are many smaller or unprofitable firms whose business models remain unproven. That tension between blockbuster results at the top and uncertainty lower down the chain is likely to remain a feature of AI markets for some time.

Regulatory And Geopolitical Headwinds

Alongside the strong financial performance, Nvidia faces complex regulatory and geopolitical challenges. Export controls on advanced AI chips to China have already affected the company’s ability to sell certain high end products into one of the world’s largest technology markets.

During the latest earnings discussion, senior executives reiterated their disappointment over restrictions that curb exports of some Nvidia chips to Chinese customers. They stressed the importance of securing the support of developers worldwide and signalled a desire to stay engaged with both United States and Chinese authorities to find workable frameworks that allow innovation while respecting national security concerns.

Any further tightening or loosening of export rules will remain an important factor for Nvidia’s growth trajectory, given that AI infrastructure is now a central element of both economic competition and national security planning.

Strategic Partnerships And New Data Center Investments

Nvidia’s leadership in AI hardware has made it a central partner for many of the most prominent companies working on advanced AI models. Deals spanning cloud providers, foundation model developers and new AI labs put Nvidia chips at the core of large scale data center buildouts.

Recently announced plans for massive data center complexes in partnership with leading AI firms, as well as ongoing commitments from global cloud platforms, underline how deeply embedded Nvidia has become in the infrastructure of the AI era. New sites are being designed from the ground up around Nvidia’s GPU platforms, power requirements and networking solutions, reinforcing the company’s strategic importance across the ecosystem.

At the same time, the intricate web of investments and cross shareholdings between Nvidia and AI software companies has drawn the attention of regulators. Officials are examining whether certain arrangements could limit competition or entrench a small group of dominant players, although no final conclusions have been reached.

What The Results Mean For Everyday Investors

For individual investors, the latest Nvidia earnings carry several key implications

- Demand for AI infrastructure remains strong, at least for now, as evidenced by the company’s revenue growth and order backlog.

- Nvidia continues to hold a dominant share of the high end AI GPU market, which helps sustain pricing power and margins.

- Market volatility around AI themes is likely to persist, as optimism about long term growth collides with short term concerns over valuations and regulatory risks.

Investors who already hold Nvidia stock may see the results as confirmation of the company’s central role in AI, while those considering entry need to balance that strength against the possibility of future corrections if sentiment turns. As always, diversification and a long term horizon are important tools for managing risk.

Frequently Asked Questions

1. Why did Nvidia shares rise after the latest earnings report?

Nvidia shares moved higher because the company reported quarterly revenue above analyst expectations and issued a stronger than expected sales forecast for the next quarter. The results suggested that demand for its AI chips remains very strong, easing some market worries about a slowdown in AI spending.

2. How important is the data center business to Nvidia’s growth?

The data center division is now the main driver of Nvidia’s revenue and profit. It supplies GPUs and complete systems that power AI training and inference in global data centers. In the latest quarter, this segment accounted for the vast majority of total sales, highlighting how central AI infrastructure has become to the company’s success.

3. Is there really an AI bubble, and how does Nvidia fit into that debate?

Some analysts worry that parts of the AI sector are overvalued, especially among smaller, unprofitable companies. However, Nvidia’s strong revenue growth, high margins and clear demand visibility have led others to argue that fears of an AI bubble are overstated, at least for large, profitable firms that supply core infrastructure. Nvidia’s results are therefore used as a key data point in the bubble debate.

4. How do export controls on China affect Nvidia?

United States export rules limit the sale of certain advanced AI chips to Chinese customers. These restrictions have affected Nvidia’s ability to ship some of its most powerful products into China, a major technology market. The company has developed alternative chip versions for that market, but executives have expressed frustration about the limits and continue to engage with regulators on both sides.

5. Where can investors find official information about Nvidia’s earnings and guidance?

The most reliable source of information is Nvidia’s own investor relations website, where the company publishes quarterly results, presentations, regulatory filings and guidance. Investors can also follow official press releases and listen to recorded earnings calls, all of which are linked from the investor relations section of www.nvidia.com.

Conclusion

Nvidia’s latest quarter delivered what markets were eagerly awaiting strong revenue growth, an even stronger outlook and a clear message from management that AI demand remains robust. The company’s performance has once again reinforced its status as a cornerstone of the global AI buildout and a critical indicator for the broader technology sector.

Yet the numbers also sit within a more complicated narrative that includes bubble fears, geopolitical tensions and regulatory scrutiny. For now, Nvidia’s execution and leadership in AI hardware are keeping those concerns in check, but investors will continue to watch closely to see whether the company can sustain its momentum as the AI landscape evolves.

For More Information Click HERE